January 17, 2021

by Rhonda Duffy

This letter is about how to sell your business for the most money possible, TAX FREE!

DUFFY Realty started in 2002. Moreover, than a long history in Atlanta and licensing across the country, DUFFY has been highly successful launching me to the number one spot for sold residential properties four years in a row. The model works and the public loves it. Bingo! You have a winner. And then what? You want to retire and travel when your kids go to college.

So as many businesses do we started thinking about options. However when we met with the Business Broker (albeit it was only one) they were not too impressive. They spoke of competitors in our books with the proper disclosures of course, but that they would likely be the buyer.

That made me cringe. No way. We put that aside. I had rather close I thought.

So time passed and Frank and I were at a business seminar in August of 2015 taking notes like crazy and ESOP was mentioned.

What, ESOxxx? What is that? Oh, it is an option for exit and did we mention that it makes your company tax free and that you can get your money as the selling shareholder tax free. And, it is a pension plan on steroids for your employees and makes them loyal. Moreover that it holds better retention and production. What is this? ExxSP? I don’t know when you have had great news lately but this hit us like a bottle rocket to the brain. We were so excited about another opportunity! ESOP stands for Employee Stock Ownership Plan.

So the journey began and I want to warn you that when Rhonda and Frank get started on a mission, we ride on a rocket. For instance, we are relentless to find the best advice for the best value. We despise over paying for anything yet we know that we must find competent structure.

First we were told about a law firm that the speaker had talked to. Well we were told that they helped the speaker only to find out later after a lot of questions that that was not the truth. Moreover, we were suspicious of them anyway because the fee that they were charging seemed absorbent to the point that it would take too long to break even.

So in Frank and Rhonda fashion we started asking everyone we knew about this strange thing ESOP. After that and a few days and many calls later, we found an accountant that was highly recommended to do ESOP accounting. Our accountant declined saying that it is highly specialized. After that we found an attorney that just so happened to work at the high priced law firm doing ESOPs before he joined another firm. BINGO!

Most importantly, he charged 1/6th of the fee. YES, now we are cooking with grease.

We took the questions that we asked of the other firm and some that we made up and found that he was legit. So how long will this take? First firm said 7 months, this guy, 2 months! Wow, OK.

Next we need an Evaluation Company that can give us a value of the company. OK got that. But wait, what if we had a consultant that could help us increase our value, that could be worth something. So we hired an expert and guess what? We got 1.5 million more in the evaluation. Above all, we are winning!

OK now we need a Trustee. We dug around some more and ended up using the Trustee that was recommended by the first law firm.

Now we need someone who can help with the paperwork and yearly calculations for Employees. Hired them.

I must say, I dreaded the work to do the ESOP but in hindsight the whole work of putting together the documents and facts for the ESOP as well as the continued yearly work is simply staying organized. The ESOP itself has been easy.

An, the workhorses that drive DUFFY have stayed at DUFFY to reap the rewards of the profit now and the big profit when the Owner Financed Seller note is finished.

Now to what you really want to know, yes, we have taken Millions of Dollars tax free we sold our business for more money. DUFFY does not pay corporate taxes which also makes DUFFY profitable. Frank and I still run DUFFY with the help of the vested Employees and we are on our Freedom Tour 2020 and 2021. In conclusion, we are paid a salary and we make the interest on the Seller Owner Financed Note.

Above all, the ESOP was the best thing we have ever done in business.

Now back to the Business Broker their suggested selling price was 40% of what our ESOP evaluation turned out to be and that was before a tax free gain!

Need help? Let’s talk. In conclusion, we have lived through the ESOP since October 2015 and we can get you on the right track. Moreover, we have the resources and know what to do. Most importantly, this is a game changer for business owners.

IRS Reference About ESOPs: https://www.irs.gov/retirement-plans/employee-stock-ownership-plans-esops

Frank Duffy

frankwithduffyrealty@gmail.com

770.367.2642

Sell Your Business For the Most Money

Options for how to sell your business for the most money:

Sell your business to another buyer and be done but have no control over what happens to it.

Do an Employee Stock Option Plan (ESOP) and sell for more money, protect your employee legacy, have no one looking at your trade secrets.

Considering ESOPs have not been as popular as selling outright there are many assumptions and misconceptions regarding the process.

Let us help you solve some of these misconceptions!

- #1: Selling shareholders will lose control to employees.

- #2: Management or employees will have to fund the purchase.

- #3: The company must be a particular entity type.

- #4: ESOPs are expensive to administer post-closing.

- #5: Employees will have access to sensitive company financial information.

- #6: Sellers will not receive a fair purchase price.

- #7: ESOP will prevent a subsequent sale of the company.

- #8: You need a large payroll.

Most importantly, the GREAT news – you ARE in control with an ESOP!

Here are all the benefits to sell your Business for the most money!

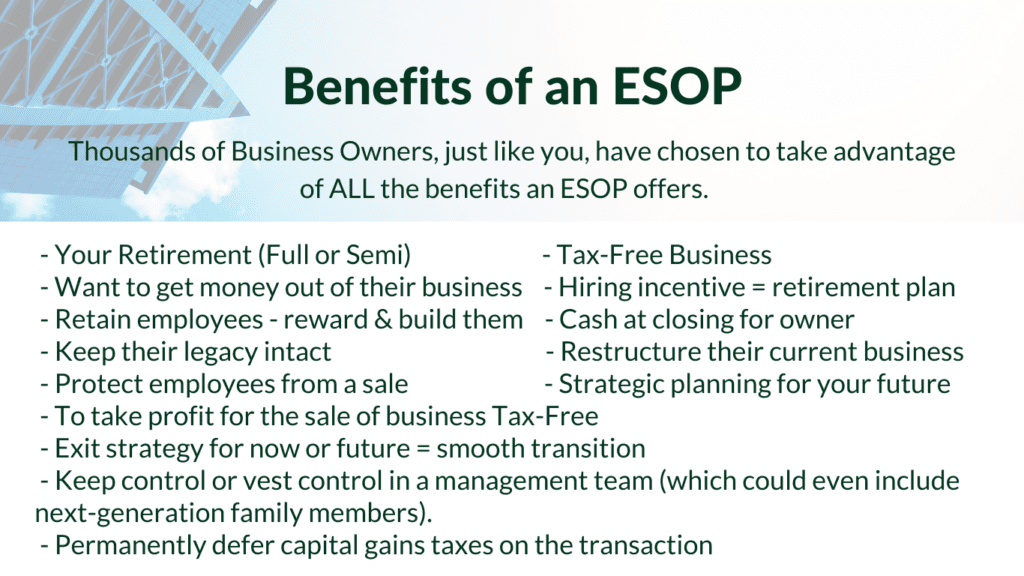

Benefits of an ESOP:

- Retirement – Full or Semi – Your choice!

- Get money out of your business

- Make the Business Tax Free

- Retain employees – reward & build them

- Hiring incentives = retirement plan

- Profit for the sale of the business Tax Free

- You can protect your employees from a sale

- Strategic planning for your future

- Exit strategy for now or future = smooth transition

- Restructure your current business

- Keep your legacy intact

- Cash at closing for the owner

- Keep control or vest control in a management team (which could even include next generation family members).

- Permanently defer capital gains taxes on the transaction

In conclusion, we would love to help you sell your business for the most money possible with an ESOP! We know all the ins and ou